Click here to download Marketplace Taxes for free!

Minimum Requirements

Marketplace Taxes requires a minimum of PHP 5.6 and WooCommerce 3.0.

In addition, one of these compatible marketplace plugins must be installed:

- WC Vendors 1.9.14+ OR WC Vendors Pro 1.4.4+

- Dokan 2.6.0+

Installing Marketplace Taxes

To install Marketplace Taxes:

- Log into your WordPress site.

- Go to Plugins > Add New.

- Search for ‘Marketplace Taxes.’

- Find Marketplace Taxes in the search results and click Install Now.

- When the installation completes, click Activate.

Updating existing seller orders (WC Vendors only)

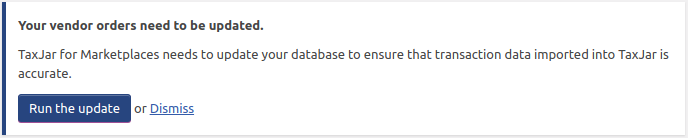

If there are one or more seller sub orders in your database when Marketplace Taxes is activated, a notice will be displayed asking you to update them.

If you want your sellers to be able to import existing orders and refunds into TaxJar, you must Run the update. Otherwise, you may Dismiss the update notice.

If you Run the update, Marketplace Taxes will start updating your seller orders in the background. A success message will be displayed once all orders have been updated.

Admin Settings

Once Marketplace Taxes is installed and activated, you can access the plugin settings one of two ways:

- On the Plugins screen, find Marketplace Taxes and click on the Settings link.

- Go to WooCommerce > Settings > Integration > Marketplace Taxes.

No matter how you access the settings page, these will be your options:

Enable

Use this option to enable or disable automated tax calculations. When tax calculations are disabled, TaxJar will not be used to calculate the tax to collect at checkout.

TaxJar API token

Enter your TaxJar SmartCalcs API token in this field. Your API token will be used to calculate the tax to collect from the customer at checkout.

Seller of record

In sales tax jargon, the seller of record is the person or entity responsible for collecting and remitting sales tax on each sale. This option allows you to choose whether you or your merchants will act as the seller of record. You have two options:

- Marketplace – You will act as the seller of record. You will be responsible for determining whether you have sales tax nexus in each state, registering to collect sales tax in the states where you have nexus, and filing and remitting sales tax when it’s due.

- Vendor – Your merchants will act as the seller of record. Each seller is responsible for setting up their tax collection settings correctly, registering to collect sales tax, and filing and remitting sales tax when it’s due.

In most cases your merchants will act as the seller of record, and this is the default. Please ensure that you understand the consequences of being the seller of record before you change this setting.

Business locations

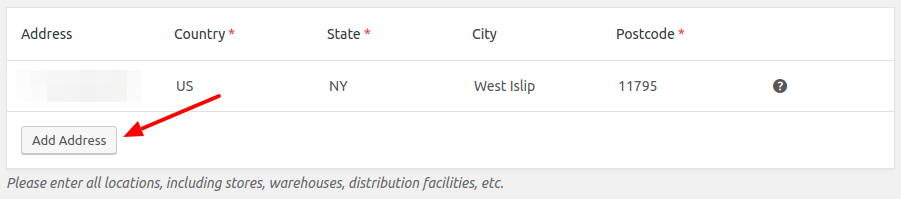

When Seller of record is set to Marketplace, a table of Business locations will appear. The addresses in this table are used by TaxJar to determine where your business has sales tax nexus.

By default, your WooCommerce store address will be used as a business location. To add additional locations, simply click Add Address.

Sales tax reporting

Check this box to upload orders and refunds to TaxJar for reporting. Please note that every order and refund uploaded to TaxJar will count against the monthly transaction limit for your TaxJar account.

Seller Settings

When your merchants are acting as the seller of record, tax settings will appear in the seller dashboard.

If you’re running WC Vendors, these settings will appear under Settings > Taxes (WC Vendors Pro) or Shop Settings > Taxes (WC Vendors Free).

If you’re running Dokan, they will be located under Settings > Tax.

The following options are available to sellers:

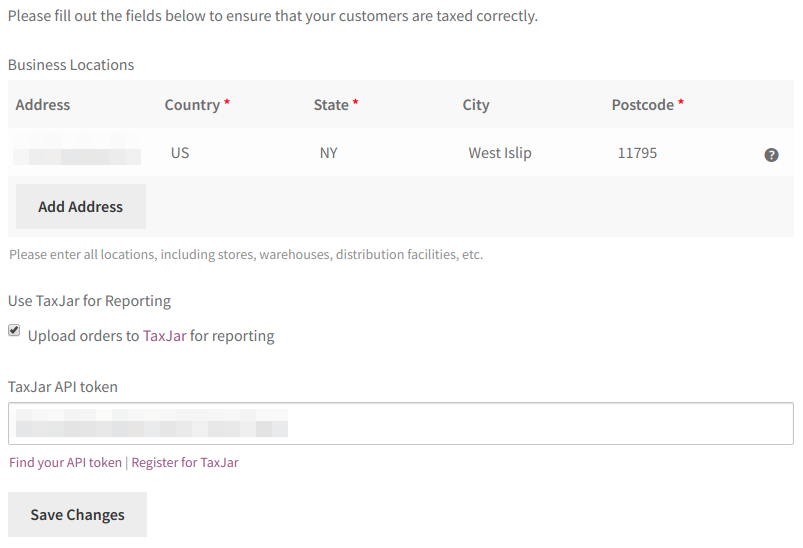

Business Locations

The addresses entered in this table are used to determine where the seller has sales tax nexus. The seller’s Store Address and Ship From address (if any) will be used as business locations by default. Additional addresses can be added by clicking Add Address.

Use TaxJar for Reporting

When this checkbox is selected, the seller’s orders and refunds will be uploaded to TaxJar for reporting. Every uploaded order and refund will count against the seller’s monthly transaction limit.

TaxJar API token

This field appears when Use TaxJar for Reporting is checked. The seller must enter a valid TaxJar SmartCalcs API token in order for reporting to work.

Further Reading

For more information on your options for handling sales tax, please consult TaxJar’s Sales Tax Guide for Online Marketplace Providers.

Click here to download Marketplace Taxes for free!

TRADEMARK DISCLAIMER

TaxJar is a trademark of TPS Unlimited, Inc. The Plugin Pros is not affiliated with or endorsed by TPS Unlimited, Inc.